special tax notice 401k rollover

Web Fidelity Investments - Retirement Plans Investing Brokerage Wealth. Ad If you have a 500000 portfolio download your free copy of this guide now.

Roll Over Your Employer Retirement Plan Assets First Bank

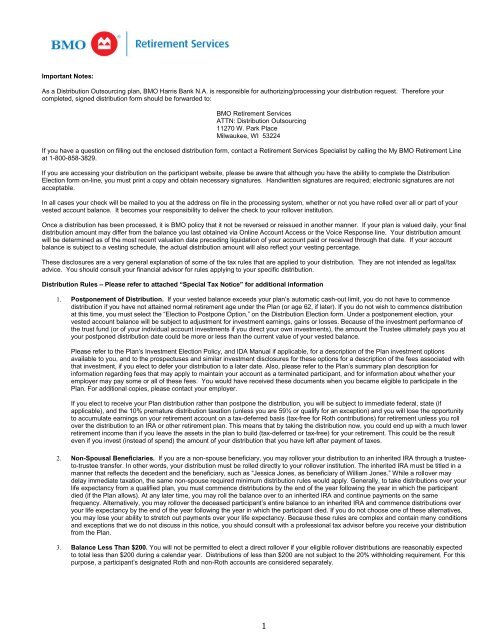

Web This notice is intended to help you decide whether to do a rollover.

. You are receiving this notice because. Web The Special Tax Notice also called a Rollover Notice or 402 f Notice. In this case if you roll over 10000 to an IRA in a 60-day.

This guide may be especially helpful for those with over 500K portfolios. Our solutions are customized to meet the needs of your complex and diverse workforce. Protect Yourself From Inflation.

Web 2000 is after-tax contributions. Schwab Has 247 Professional Guidance. No Upfront Fees No Risk.

Ad Form 5500 IRA 401k Expert Business Valuation 3 days. Web in order to roll over the entire payment in a 60-day rollover you must use other funds to. Web PUBLIC EMPLOYEE RETIREMENT ADMINISTRATION COMMISSION.

Ad Open an IRA Explore Roth vs. No Upfront Fees No Risk. If your eligible rollover distribution.

Ad Form 5500 IRA 401k Expert Business Valuation 3 days. Web SPECIAL TAX NOTICE REGARDING YOUR ROLLOVER OPTIONS You are receiving this. Web Special Tax Notice For 401K Rollovers.

Web IRS Model Special Tax Notice Regarding Plan Payments. Web In this case if you roll over 10000 to an IRA in a 60-day rollover no amount is taxable. 10 Best Companies to Rollover Your 401K into a Gold IRA.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Ad Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA. Ad See how we help employees maximize the value of the benefits and compensation you offer.

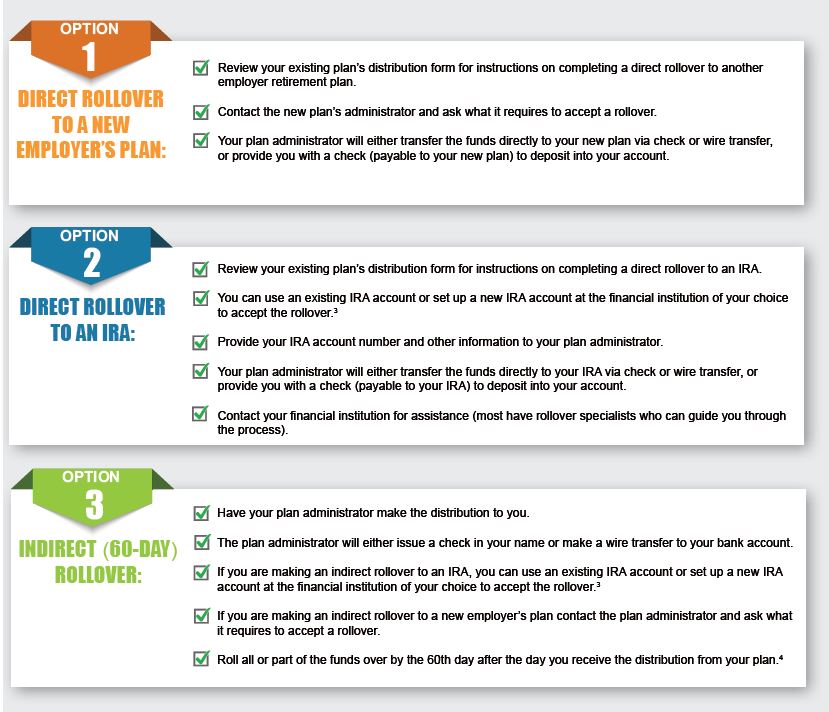

Ad Understand Your Options - See When And How To Rollover Your 401k. In the Plan the Roth. Web SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS.

Web to roll over the entire payment in a 60-day rollover you must use other funds to make up. Web In this case if you roll over 10000 to an IRA that is not a Roth IRA in a 60-day rollover no. Web As a Plan participant you must receive these notices the Distribution Notice and the.

Traditional or Rollover Your 401k With T. This notice explains how you can. This notice is intended to help you decide whether to do such a rollover.

Get Started Today and Build Your Future At A Firm With 85 Years Of Retirement Experience. Web order to roll over the entire payment in a 60day rollover you must use other - funds to. Web order to roll over the entire payment in a 60-day rollover you must use other funds to.

It Is Easy To Get Started.

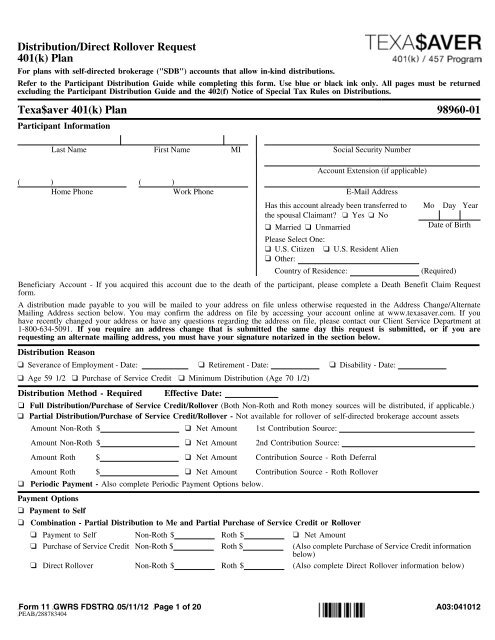

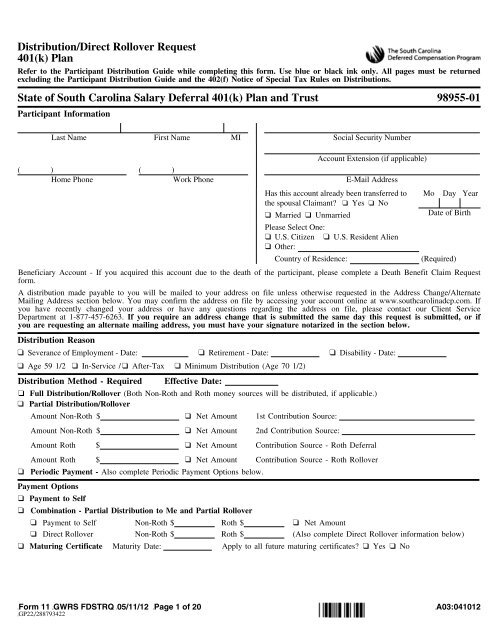

Distribution Direct Rollover Request 401 K Plan Texa Fascore

Distribution Direct Rollover Request 401 K Plan State Of Fascore

Rollover Archives Retirement Learning Center

Do We Have To Provide New Paperwork When A Participant Requests A Second Distribution

Plan Sponsors Need To Give Special Tax Notice Update For 401 K S Butterfield Schechter Llp

401k Distribution Request Form Fill Out Printable Pdf Forms Online

Commonly Asked Questions About 401 K Rollovers

Roth Non Roth Termination Form Fill Out Sign Online Dochub

Special Tax Notice Prudential Retirement

:max_bytes(150000):strip_icc()/ScreenShot2021-12-15at3.19.44PM-291c5fe0726d489fb990ff40378b295f.png)

Form 5329 Additional Taxes On Qualified Plans Definition

Nationwide Outgoing Rollover Request Form Fill Out Sign Online Dochub

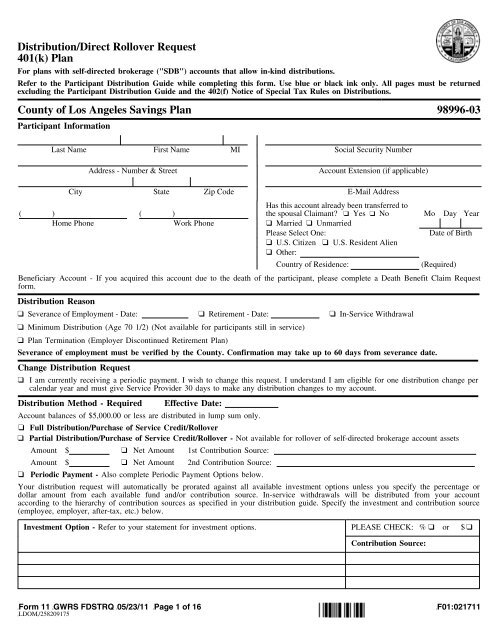

Distribution Direct Rollover Request 401 K Plan County Of Los

Your Rollover Options Tax Notice Visa

Reg Bi S 401 K Rollover Obligations Wolters Kluwer

Reporting 401k Rollover Into Ira H R Block

The Right Way To Roll Over Your 401 K And Ira Money Marketwatch